nevada vs california income taxes

California Rankings accurate as of 2021. A common misconception is that Nevada corporations arent required to pay income tax in the state of California.

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

In reality however California imposes an income tax on.

. Property Tax In Nevada vs. State Individual Income Tax Rates and Brackets for. Notably the Corporate Income Tax in California remains one of the highest in the country perching at a startling 884 percent.

This tool compares the tax brackets for single individuals in each state. Taxes on a 1000000 is approximately 6000. With a top marginal income tax rate of 123 percent Nevada vs California taxes are known for having the highest state income tax bracket in the country.

For more information about the income tax in these states visit the Arizona and Nevada income sales tax nevada vs california tax pages. This tool compares the tax brackets for single individuals in each state. In Nevada if you earn 90000 you are taxed at a rate of 105.

Use this tool to compare the state income taxes in Nevada and California or any other pair of states. The median home price in California is 600000 while the median home price in Nevada is 300000. For more information about the income tax in these states visit the.

Buts its common to pay about 5 of your income. The most significant taxes you pay in Nevada are sales tax property tax and excise taxes for items like cigarettes and alcohol. This rate however does.

California is in the high tax state. And Im talking about income taxes. However if you live and do most of.

Income tax rates vary a lot from state to state. The state of California also ranks 40th in corporate tax. Personal Income Taxes The personal income tax rates in California range.

For income taxes in all fifty states see the income. When comparing Nevada LLC vs California LLC the most common thing people notice is that theres no personal income tax in Nevada. Californias Franchise Tax Board.

Sales Tax The statewide sales tax rate in. When living in a state that has an average income. California Businesses in Nevada vs.

Californias top marginal rate is the highest in the nation though it only pertains to taxpayers that make more than 1 million of taxable income. Nevada on the other hand is known to tax less. Compare Your State Businesses in Nevada vs.

Use this tool to compare the state income taxes in California and Nevada or any other pair of states. In California if you earn 110000 per year you are taxed at a rate of 126.

California S Tax System A Primer Chapter 1

Nevada Vs California Taxes Explained Retirebetternow Com

2022 Federal State Payroll Tax Rates For Employers

Unaffordable California It Doesn T Have To Be This Way

Nevada Income Tax Calculator Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

California Retirement Tax Friendliness Smartasset

State Taxation Of Hsas The Hsa Report Card

Individual Income Taxes Urban Institute

Tax Hike On California Millionaires Would Create 54 Tax Rate

California S Tax System A Primer

10 Best States For Taxes Vs 10 Worst States For Taxes Infographic

State Corporate Income Tax Rates And Brackets Tax Foundation

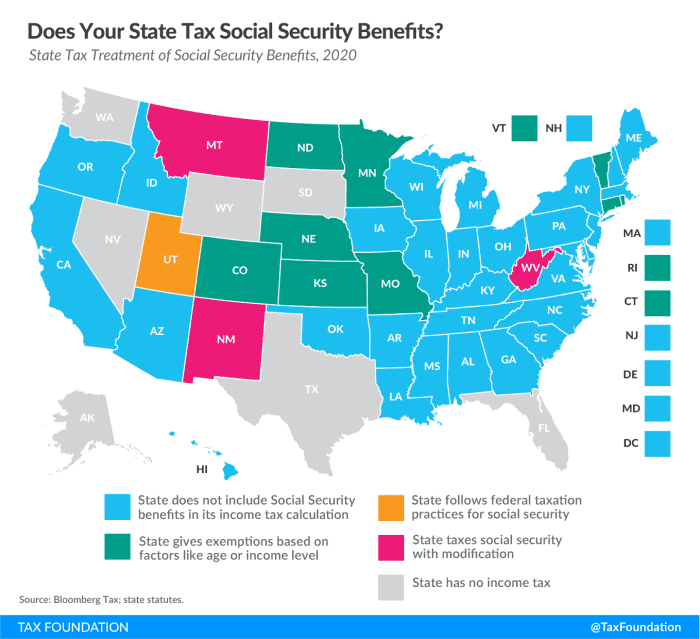

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

Nevada Vs California R Infographics

Ohio Collected 34 9b In State Taxes In 2021 9th Highest In Country Cleveland Com

How Do State And Local Corporate Income Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)